Petty Cash Management – all you need to know

Petty cash is a little amount of money that organizations have to manage. In this article, I am going to tell you all about “Petty Cash Management.” If you are looking for further information about it then you are at the right place.

Petty cash management overview

Petty cash is a little amount of money that branches and departments store for minor and sudden expenses. The petty cash management system is the system in which organizations manage their petty cash.

Why do companies require petty cash?

Companies need petty cash to have a small amount of money on hand for small, routine expenses that may arise, such as buying office supplies or paying for minor repairs. Having petty cash available allows employees to quickly and easily make these small purchases without having to go through the formal process of requesting and issuing a check or making an electronic transfer. Additionally, petty cash can also be used to provide change to customers.

What are the advantages of having petty cash?

- Convenience: it allows employees to quickly and easily make small purchases without having to go through the formal process of requesting and issuing a check or making an electronic transfer.

- Speed: it allows fast payment to be made when the need arises.

- Flexibility: it can be used for various small expenses that may arise unexpectedly.

- Cost-effective: it helps to save on the cost of check writing and bank transaction fees.

How to set a system for petty cash management

1. Process and policies for petty cash management:

Establish clear guidelines and procedures for requesting, obtaining, and using petty cash.

Specify the types of expenses that can be covered by petty cash.

2. Hire a petty cash custodian:

Identify a trustworthy and reliable individual to be responsible for managing the petty cash fund.

Provide them with proper training and resources to properly handle the fund.

3. Fix the petty cash fund:

Determine the amount of money to be kept in the petty cash fund.

Assign a responsible person to handle petty cash transactions.

4. Secure petty cash:

Keep the petty cash in a secure location that is accessible only by authorized personnel.

Implement controls to prevent fraud or misuse of funds.

5. Bookkeeping of funds:

Keep accurate records of all petty cash transactions including the date, amount, purpose, and receipts

6. Storage of receipts:

Create a system for storing and organizing receipts for petty cash transactions.

Ensure that receipts are easily accessible and kept in a secure location.

7. Auditing petty cash:

Regularly audit the petty cash fund to ensure that all transactions are recorded correctly and that the fund is being used properly.

Identify and address any discrepancies or issues found during the audit.

Review the system and policies periodically and make necessary changes.

What are the challenges that companies may face in petty cash management?

- Theft or misappropriation of funds: Without proper controls and oversight, employees may be tempted to steal or misuse petty cash.

- Difficulty tracking expenses: It can be difficult to track how petty cash is being spent, making it hard to reconcile the account and identify any discrepancies.

- Lack of accountability: Without clear guidelines and procedures in place, it can be difficult to hold employees accountable for how they are using petty cash.

- Difficulty budgeting: Without accurate information on how much petty cash is being spent, it can be hard to budget for and manage expenses effectively.

- Inadequate controls and oversight: Without proper controls and oversight, it can be difficult to detect and prevent fraud and mismanagement of petty cash.

- Lack of proper documentation: Not having the proper documentation for petty cash transactions can make it difficult to reconcile the account and identify any discrepancies.

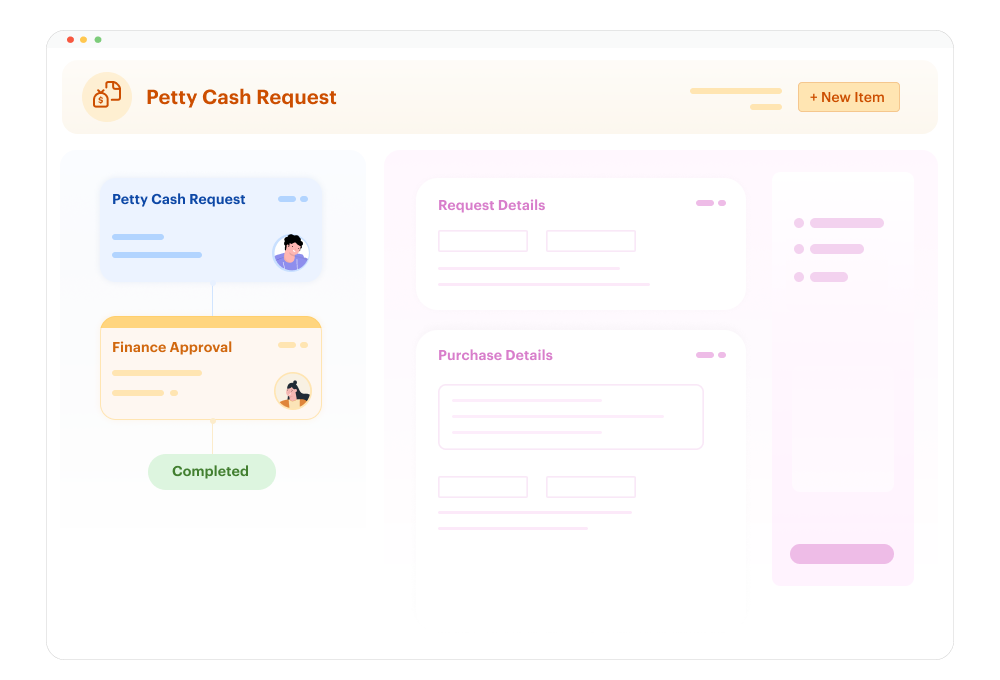

Is an automated petty cash management system beneficial for companies?

- Improved security: Automated systems can provide better security controls to prevent theft or misuse of funds.

- Increased efficiency: Automated systems can streamline the process of tracking and reconciling petty cash expenses, making it easier to manage expenses and budget for future needs.

- Better record keeping: Automated systems can provide detailed and accurate records of petty cash transactions, making it easier to track expenses and identify any discrepancies.

- Better control and oversight: Automated systems can provide management with greater visibility into how petty cash is being used, making it easier to identify and address issues.

- Better compliance: Automated systems can help ensure compliance with company policies and government regulations by providing detailed records and real-time oversight of petty cash expenses.