Step-by-Step Guide to CIBIL Consumer Login for Credit Monitoring

Monitoring your credit score is a vital aspect of maintaining your financial well-being. By keeping a close eye on your credit score, you can identify any discrepancies or fraudulent activities early on, which allows you to address them promptly.

Regular monitoring also helps you understand the factors influencing your score, enabling you to make informed decisions about managing your credit and improving your financial health. Additionally, a good credit score can open doors to better interest rates on loans and credit cards, saving you money in the long run. In essence, being proactive about your credit score is a crucial step towards achieving financial stability and security.

The Credit Information Bureau (India) Limited (CIBIL) offers a comprehensive platform for individuals to keep track of their credit information through the CIBIL consumer login. This step-by-step guide will help you navigate the CIBIL member login process, allowing you to monitor your credit effectively.

Importance of monitoring your credit score

Before we get into the login process, it is important to understand why monitoring your credit score through CIBIL member login is essential:

- Creditworthiness: A good credit score enhances your credibility with lenders, increasing your chances of loan approval.

- Interest rates: Individuals with higher credit scores often receive loans at lower interest rates, saving significant amounts of money in the long run.

- Fraud detection: Regular credit monitoring helps detect any unauthorized activities or inaccuracies, allowing for timely corrective actions.

- Financial planning: Understanding your credit status helps in making informed financial decisions and planning effectively for future financial needs.

Creating your CIBIL account

To start monitoring your credit score, you need to create an account on the CIBIL portal. Follow these steps to create your CIBIL account and begin using the CIBIL member login:

Step 1: Visit the CIBIL website

- Open your preferred web browser and go to the official CIBIL website at www.cibil.com.

Step 2: Click on ‘Get your CIBIL Score’

- On the homepage, find and click on the ‘Get Your CIBIL Score’ button. This will redirect you to the subscription page.

Step 3: Choose your subscription plan

- CIBIL offers various subscription plans tailored to different needs. Review the plans and select the one that best fits your requirements. Click on ‘Subscribe Now’ to proceed.

Step 4: Fill in personal details

- You will be prompted to fill in your personal details, including your name, date of birth, residential address, email ID, and phone number. Ensure that all information is accurate to avoid any issues during verification.

Step 5: Identity verification

- CIBIL will verify your identity by asking a series of questions related to your credit history. Answer these questions accurately to complete the verification process.

Step 6: Payment

- After successful identity verification, proceed to the payment section. Complete the payment process for your chosen subscription plan using a credit card, debit card, or net banking.

Step 7: Account creation

- Once the payment is successful, your CIBIL account will be created. You will receive a confirmation email containing your login credentials and a link to the login page.

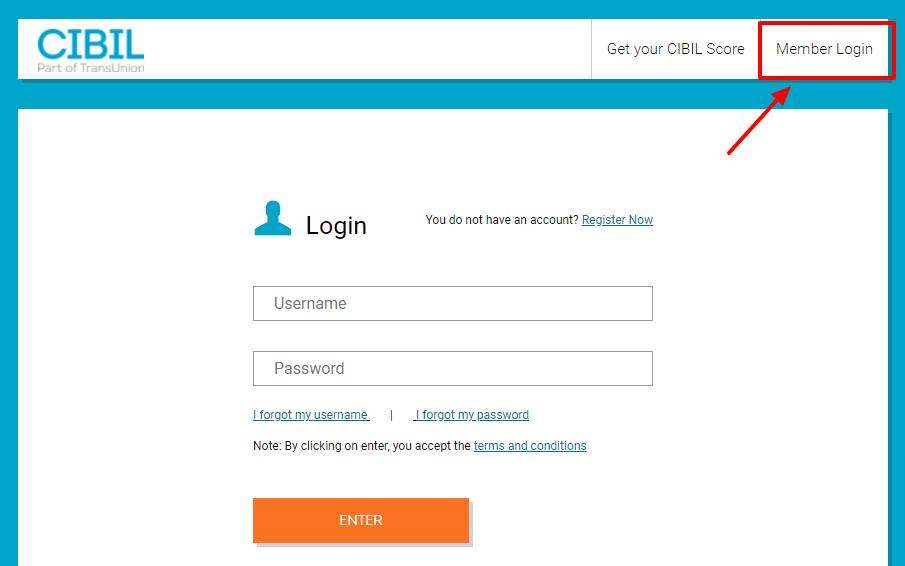

Logging into your CIBIL consumer account

Now that you have created your CIBIL account, follow these steps to log in using the CIBIL consumer login:

Step 1: Access the login page

- Visit the CIBIL website again and click on ‘Member Login’ at the top right corner of the homepage. Alternatively, you can go directly to the CIBIL consumer login page.

Step 2: Enter your credentials

- Enter the registered email ID and the password you created during the account setup process in the respective fields.

Step 3: Complete CAPTCHA

- Fill in the CAPTCHA code displayed on the screen to verify that you are not a robot. This step helps in maintaining the security of your account.

Step 4: Click on ‘Login’

- Click the ‘Login’ button to access your CIBIL account dashboard.

Navigating the CIBIL dashboard

Once you are logged in through the CIBIL consumer login, you will be directed to the CIBIL dashboard, which offers a range of features and tools. Here’s a detailed breakdown of what you can do:

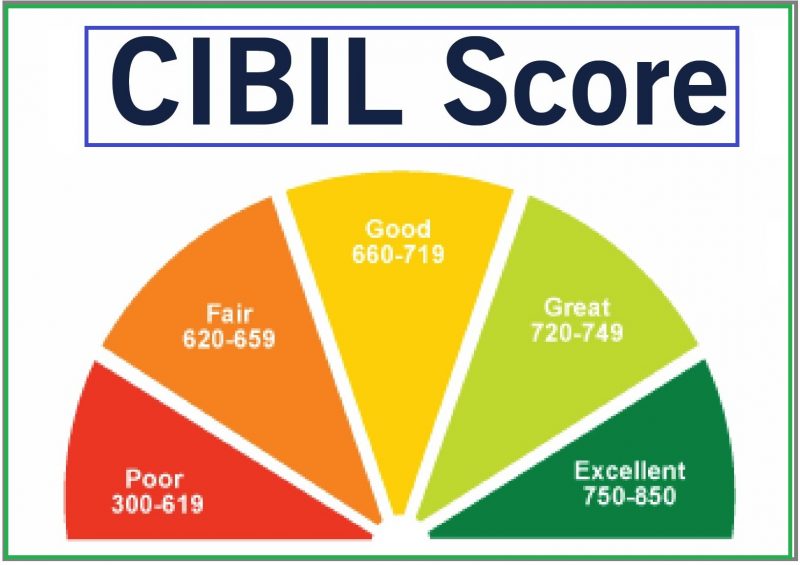

View your CIBIL Score

- Your current CIBIL score will be prominently displayed on the dashboard. This score is a three-digit number ranging from 300 to 900, with higher scores indicating better creditworthiness.

Download your credit report

- You can download a comprehensive credit report, which includes detailed information about your credit history, account details, and any inquiries made by lenders. This report is essential for understanding your overall credit profile.

Monitor credit activity

- Regularly check for any new activities or changes in your credit accounts. This includes new credit inquiries, changes in credit limits, and any new accounts opened in your name.

Dispute resolution

- If you find any discrepancies or inaccuracies in your credit report, you can raise a dispute directly from the dashboard. CIBIL provides a streamlined process for resolving disputes, ensuring that your credit information remains accurate.

Tips for effective credit monitoring

To make the most of your CIBIL consumer login, consider the following tips:

Regular checks

- Make it a habit to log in to your CIBIL account regularly, at least once a month, to monitor any changes in your credit score or report. This helps in staying informed about your credit status.

Understand your report

- Take the time to thoroughly understand the different sections of your credit report. Familiarise yourself with the terms and information presented to make informed decisions about your credit health.

Dispute errors

- If you find any errors in your credit report, do not hesitate to raise a dispute. Timely resolution of discrepancies is crucial to maintaining an accurate credit profile and avoiding potential negative impacts on your score.

Use alerts

- Set up email or SMS alerts for significant changes in your credit profile. This proactive approach helps you stay on top of your credit status and take immediate action if any suspicious activity is detected.

Maintaining a good credit score

Maintaining a good credit score through regular use of the CIBIL consumer login is vital for several reasons:

Loan approvals

- Banks and financial institutions heavily rely on credit scores when approving loan applications. A higher score increases your chances of getting approved for loans and credit cards.

Better interest rates

- Individuals with higher credit scores often receive loans at lower interest rates, leading to significant savings on interest payments over time.

Employment opportunities

- Some employers check credit scores as part of their hiring process. A good credit score can positively influence their perception of your financial responsibility.

Lower insurance premiums

- Insurance companies may offer lower premiums to individuals with good credit scores, as they are considered lower-risk customers.

Conclusion

Monitoring your credit score through the CIBIL consumer login is an effective way to stay on top of your financial health. By following the steps outlined in this guide, you can easily create an account, log in, and navigate the CIBIL dashboard to keep your credit information up-to-date. Regular monitoring not only helps in maintaining a good credit score but also aids in detecting and resolving any discrepancies promptly.

Incorporate these practices into your financial routine to ensure a strong credit profile, better loan terms, and overall financial well-being. By staying proactive and informed about your credit status, you can make more informed financial decisions and achieve your financial goals with greater ease. Use your CIBIL member login regularly to keep your credit score in check and take control of your financial future.