DraftKings Stock Haircut Could Give Way to Buying Opportunity

DraftKings first made significant headlines a few years back over the controversy on whether its contests qualified as a form of gambling. In April 2024, the company swung back to headlines with news that it was going public after completing a $3.3 billion merger that combined it with Diamond Eagle. After a year of being listed on the New York Stock Exchange, DraftKings’ stock is in a tailspin. By mid-April 2024, it was down more than eight percent, driving further down from the highs it had hit in March.

While the DraftKings’ stock dip sounds like bad news on the surface, some market observers believe that the retrenchment adds to the sportsbook value. The experts consider the stock’s near-term technical outlook compelling. Schaeffer’s Investment Research indicates that the pullback sends DraftKings within one standard deviation of its moving average meant to last eighty days. This comes after a long stretch over the trendline. Rocky White, the company’s Senior Quantitative Analyst, defines it as the equity trading above the shifting average for 60% of the time for the past two months and closing above the trendline in eight of the last ten sessions.

DraftKings continues to be among the most favored gaming equities on Wall Street despite its struggling stock. The slump that began in March has the sportsbook’s share price dancing around $57, about 30% on the upside of the consensus price target set at $73.

The Major Catalyst

While there isn’t a definite reason for the lethargy in DraftKings’ stock, experts attribute it to the lack of clarity on how the mobile sports betting market will move forward in New York. Andrew Cuomo, the Big Apple’s governor, came to a consensus with other lawmakers recently on the matter and agreed to grant licenses to such firms. It is not yet clear how many operators will be awarded permits once the process begins, but analysts are stacking the odds in favor of DraftKings. The operator already has an established location-based footprint in the state and others, which positions it to benefit from a dependable multi-operator system.

DraftKings’ position in the market alongside rivals like Rush Street and FanDuel are gaming companies with the best chances at coming out on top with the current framework in New York. Therefore, even with the technical scenario of dropped share prices, the sportsbook still looks alluring to investors. DraftKings has been through five similar signals in the past three years. After all five signals, the company’s stock went back up, averaging 13.6% returns in a month. A similar move is expected to happen from the security’s current perch, sending the stock back over $70.

Another Spur

DraftKings continuing on the same downward path will serve as an upside since short sellers are likely to be forced into covering. Schaeffer points out that this factor is worth considering since there is a lot of interest in the stock. The research firm noticed that pessimism is still dominant to be undone enough to reach a record high. Short sellers now account for 37.5%, increasing their positions significantly in the two most recent reporting periods. The group also accounts for a healthy 7% of DraftKings’ total float.

The potential of DraftKings’ stock price drop being a flurry of options is aggressively confident. However, recent data released by the Chicago Board Options Exchange, NASDAQ OMX PHLX, and International Securities Exchange shows that traders are snatching up puts. This is likely due to most of them bracing for the gaming equity to drop even lower.

About DraftKings

DraftKings is one of the most successful sportsbooks to launch in the United States and venture into other markets. The gaming company was founded nine years ago by Paul Liberman, Jason Robins, and Matt Kalish, who now hold senior positions. DraftKings is well-known as a daily fantasy sports contest and sports betting operator. It welcomes users to enter fantasy sports-related contests that run daily and weekly. Players are then awarded for their performance in any of these categories:

- American Sports – NBA, NFL, PGA, MLB, and NHL

- UEFA Champions League

- Premier League

- Canadian Football League

- Tennis

- Mixed martial arts

- NASCAR

DraftKings run fantasy sports only for six years before introducing DraftKings Sportsbook in August 2018. The gaming entity became the first legal sportsbook in New Jersey and has expanded to other states like Pennsylvania, Indiana, New Hampshire, and Indiana. It also runs retail sports betting in New York, Iowa, and Mississippi.

DraftKings runs a relatively uncomplicated website where it lists all its products. These products fall into four main categories, and they are;

-

Daily Fantasy Sports

Daily Fantasy Sports is the product that struck gold for DraftKings and catapulted it to its current popularity. DFS, as it is widely known, mirrors the season-long fantasy sports, but they are condensed into shorter formats that can run from one day to a week, depending on the game. Players draft a roster of desired athletes and gain points depending on how they perform. DFS offers different contest types, with some offering head-to-head matches while others allow players to form and join leagues with friends and family. This category is available in 43 of the 50 American states, with Washington, Louisiana, Idaho, Hawaii, and three others having yet to embrace the service.

-

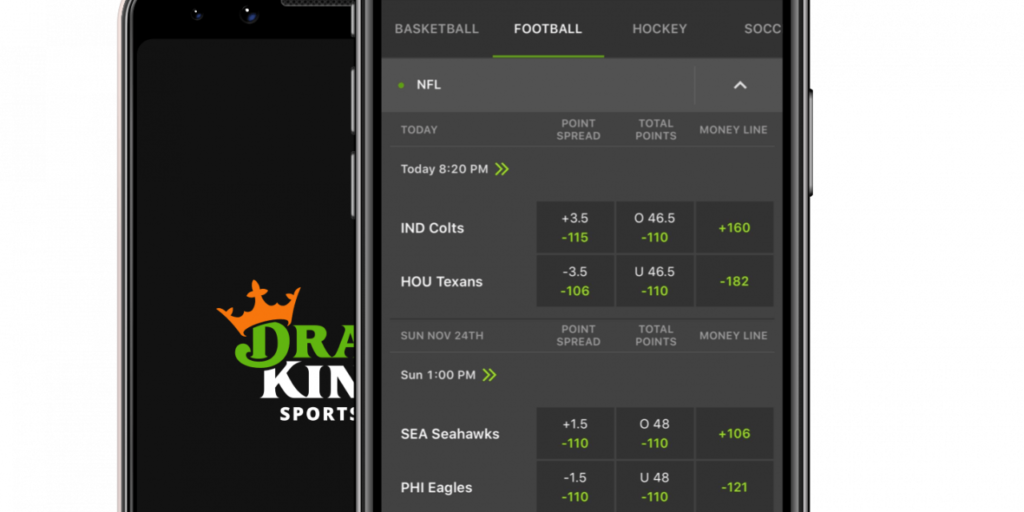

Sportsbook

DraftKings Sportsbook is a one-stop destination for nearly all betting needs offer on website or app mode. Punters can select a wide range of bets, including Parlays, Live Betting, Game Lines, Pools, Props, and Futures. Players can also access these options in retail in states like New York and Mississippi.

-

Casino

DraftKings offers a casino option in New Jersey, West Virginia, Pennsylvania, and Michigan. The section provides a selection of slots table games and live dealer sets, most of which are available to play for free or real money.

The Bottom Line

DraftKings cannot be considered an overhyped unicorn IPO even with the current drop in its stock price. Considering the success of the gaming equity in New York and having survived such storms, this one seems to have a silver lining attached to it.

The article was written with the help of an authoritative source onlineslotsx.com – a startup company focused on free slots, mainly in Canada, New Zealand, and Australia.