Is It Still Safe To Invest In Gold For Your Retirement – 2024 Guide

The interest of investors in gold bars and coins is growing every day. According to research, there is an annual increase in interest by 10%. This trend is most pronounced in Europe because due to the economic and political crisis, investors saw this as a very good opportunity. Gold is a long-term investment and should be viewed as such. The advantages of gold are that it cannot be counterfeited, nor is it subject to inflation. Also, it has no expiration date, is liquid, and is very easily converted into cash. The goal of each investment is that after a certain time, you return the invested money in an increased amount. However, investing in gold is a little different from other investments, because gold is also a protection against unfavorable economic trends. Watch this video to learn more about investing in gold.

https://www.youtube.com/watch?v=jhDIMIRQZdU

It was noticed that the price of gold rose sharply due to the coronavirus pandemic, ie by 40%. Analysts’ views are now largely focused on the United States, citing negative US real interest rates, the weakness of the US dollar, and the presidential election in early November as the first three factors that will affect the price of gold. These factors are related to each other, but also the pandemic, although Covid-19 is listed only the fourth important factor, where the possible economic impact is especially emphasized at the moment when the appearance of an effective vaccine is announced.

There are many reasons why investing in gold is profitable and here are some of them that will assure you to invest for your retirement.

1. Gold is the custodian of value

We have already said that gold is an excellent guardian of value and that in all the past years and centuries it has not lost on it, despite wars, industrial and technological revolutions, and economic crises.

2. Throughout history, gold has been money

Throughout history, we have been able to learn that gold was used as money. Although it is not used for that purpose today, at least not directly, its value has increased significantly, so that it still represents the most stable means of paying for services and goods.

3. The biggest customers are central banks

For the needs of gold reserves, central banks are happy to buy gold. Do we need to say more or is this fact enough for you to understand that this metal is a very important factor in maintaining economic stability?

4. The currency war has a positive effect on the value of gold

Even the current currency war has a positive impact on the value of this precious metal. What central banks are trying to do is bring down the values of their currencies to boost exports and reduce the foreign trade deficit.

5. Deflation? Who cares!

The positive characteristic of gold concerning inflation is known, which we wrote about earlier. However, even in times of deflationary economic crises, when securities and real estate fall in value, gold does not lose it. It grows along with the value of money or at worst stagnates. During the Great Depression in the 1930s (which has the character of a deflationary crisis), there were major stock market crashes, and the value of gold did not change. True, in the USA it was formally fixed for the dollar, but its price did not fall in the rest of the world or on the black market. The best example of the relationship between gold and deflation is the first half of 2016 when despite deflationary pressures, gold gained 30%.

6. Investing in jewelry

Buying jewelry is certainly one of the most common ways to invest in gold. However, apart from its sentimental or collector’s value, it is not considered the best investment. The value of jewelry often drops drastically even with its purchase. Expensive pieces of jewelry hold value better (as do cars), but more often because of their collector’s value than the value of gold itself, and as most jewelry is not made of pure metal, it can hardly be compared to investing in investment gold.

7. Shares of mining companies

For those who prefer to invest in stocks that are, unlike physical gold, productive assets, the investment option is stocks of mining companies. Their prices generally follow the price of gold, but in times of increased demand, they can also generate a more significant yield. But investing in them carries the risks of a typical stock investment. The advantage of this method of investing is the possibility of making a profit even when the price of gold falls because when mining gold or silver, many other valuable materials such as copper, iron, aluminum, and the like can usually be extracted from the ore. The disadvantage of this method of investing in gold is the dependence of stock price movements on the business results of mining companies. Even when the price of gold rises, the business performance of a mine or company can be poor so the stock price will fall.

What factors affect the price of gold?

The price of gold is affected by various factors such as geopolitical uncertainty, interest rates, global economic data, and the US dollar. It is therefore very important to monitor the political and economic situation to find the best time to invest.

Conclusion

Considering the concept of investing in gold, types of investments, and how to properly make a profit, it can be said that this type of investment is reliable and promising. Choosing gold will protect almost 95 percent of any global crisis because it will always remain in the price. This is proven by history – yes, a century-old history in which this metal has always had great value.

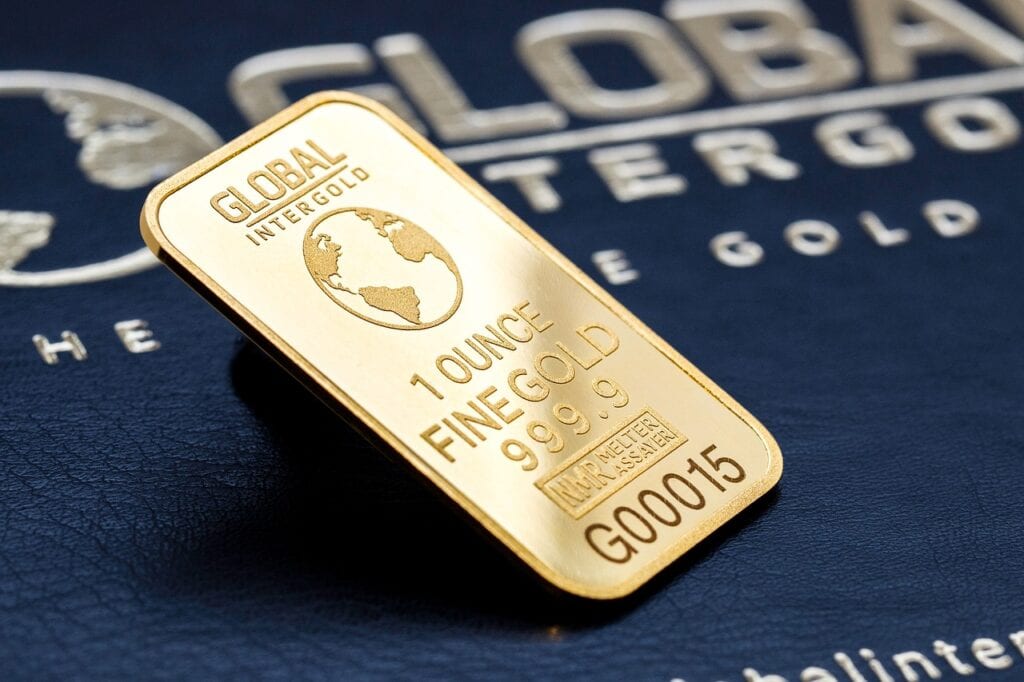

Experienced investors believe that it is best to invest in investment gold that is strictly guaranteed weight, and its purity is impeccable – 999.9. The coins also have a certificate that speaks of the quality of gold. So, start setting aside money for this smart investment for which you don’t even need too much money. In doing so, take care that the investment period is not short because you will earn more for a longer period.