The Walton family, which founded and today controls Wal-Mart, lives on blood money. Operating jointly with the City of London-Wall Street bankers, it became the world’s wealthiest family by decimating the U.S. and world physical economies, and by applying ferocious austerity, driving wages and living standards beneath the level needed for existence. Forbes magazine places the worth of the family at greater than $100 billion.

The threat posed by the Waltons is not merely in the size of their fortune. Older monied families such as the Mellons, Rockefellers, and the corrupted Ford family fortunes have been more powerful politically and financially, as have also been the much smaller family nest-eggs of George Soros and Michael Steinhardt. But the danger today is that the Waltons, with such a storehouse of wealth available to them, will use it, for one thing, to build even more Wal-Mart stores, with even more devastating effects on the world economy! But not only that:

- The Waltons are using their enormous leverage to carefully construct a banking empire, under tight family control.

- They are bankrolling a vast neo-conservative political network. For example, John Walton, who is worth more than $20 billion himself, was the largest single individual contributor to Gov. Jeb Bush in the 2002 Florida gubernatorial race.

- They are the principal financial force in the effort to privatize the public school system, through school vouchers, which would wreck public education. They would create a School-Mart.

Democratic Presidential pre-candidate Lyndon LaRouche has launched a national and international boycott of Wal-Mart, to expose and shut down the company. LaRouche has shown that under Wal-Mart’s policy of demanding that its suppliers supply goods to Wal-Mart at ridiculously low prices, the only way the suppliers can accomplish this is to shut down production in the United States, and ship it to sweatshop facilities overseas, which has caused the exodus of 1.5 million U.S. manufacturing jobs. Wal-Mart pays its workers below subsistence wages, and destroys communities. This is applied as a leading edge of a Roman Imperial-type policy, in which the American physical economy, no longer able to reproduce its own existence, sucks in a huge volume of imported goods from around the world. The more the United States feeds its import addiction, the more that destroys the U.S. physical economy, while driving the current account deficit to new and dangerous heights.

The campaign of LaRouche and , is drawing blood. Wal-Mart’s national spokesperson, Mona Williams, lashed out on Nov. 28, 2003, “There’s definitely a negative buzz out there. A lot of folks have started taking shots at us.” One magazine noted the shift: “Wal-Mart kicked off the year in the media as the nation’s ‘most-admired company,’ but it looks like it will wrap up 2003 as the ‘Beast of Bentonville’ ” (Bentonville, Arkansas is Wal-Mart’s headquarters). Last Christmas, Wal-Mart registered very slim sales growth, partly due to the faltering economy, but partly due to what the media is now highlighting as a Wal-Mart “image problem.” In the retail industry, if sales are not rising year on year, there is a problem.

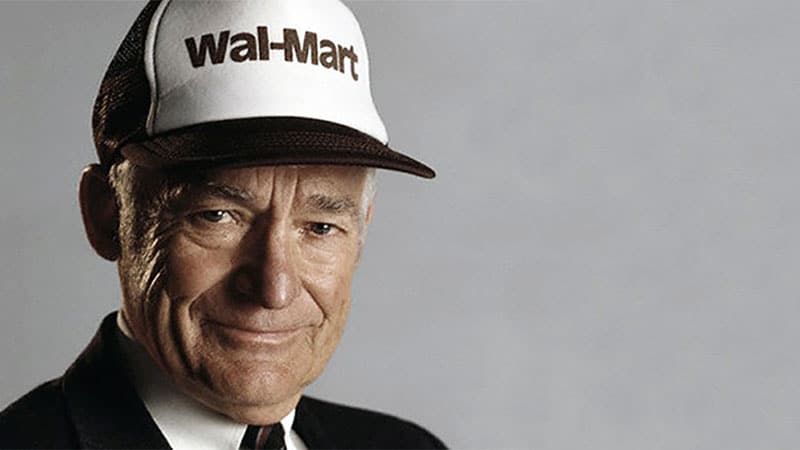

To counterattack, Wal-Mart’s officers, led by chairman Rob Walton, made a strategic decision to bring out their ultimate weapon—the Sam Walton myth—in the hope that this will dazzle and disarm people. The myth has two components. First, Wal-Mart founder Sam Walton (1918-92) is portrayed as a folksy, ol’ country boy, concerned about the welfare of his workers. According to this myth, Sam drove around in a pick-up truck, when he could have been chauffeured in a limousine. Mr. Sam, as he liked his underlings to call him, didn’t care a hoot about money, but only about following his dream.

The second part of the myth is that Mr. Sam disdained Wall Street, building his company through his own native genius and hard work.

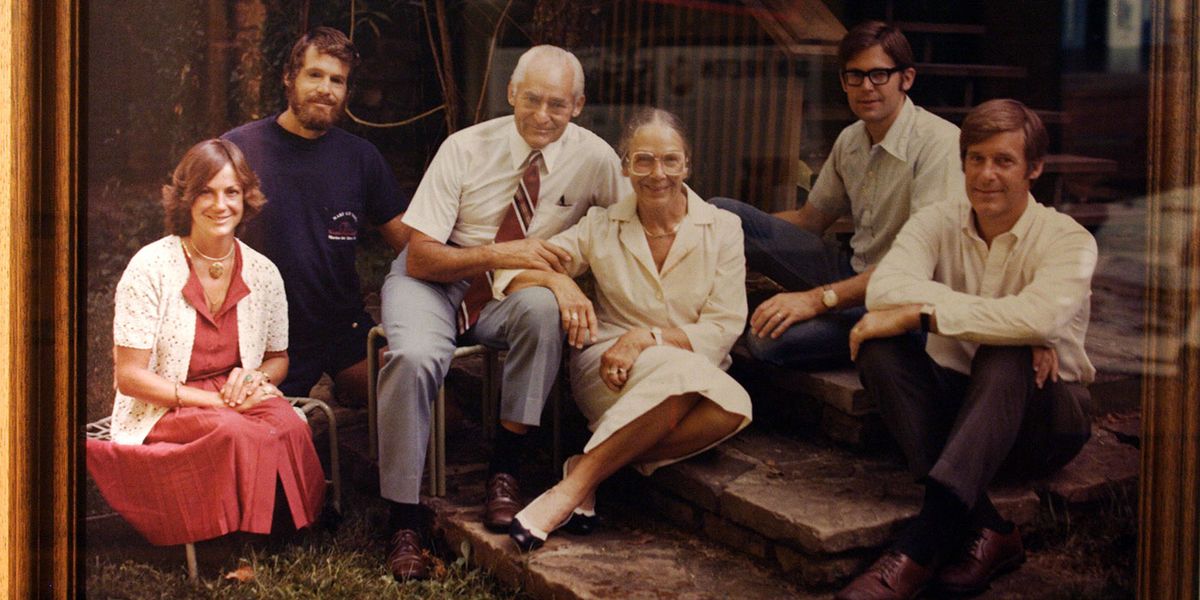

By extension, this myth is stretched to cover the rest of the Walton clan. They are a chip off the block of ol’ Mr. Sam. They use their money to help people. Their savage amassing of a $100 billion fortune hasn’t changed them; they’re just like you and me.

No one should be dazzled by this myth. The truth is that Wal-Mart made its money by crushing its employees, its competitors, its suppliers, and foreign nations. It grew only through the aid and massive funding of Wall Street, which admires Wal-Mart as the paradigm of what it wants to achieve in a post-industrial society. Two examples of this—the 1970 financing when, Wal-Mart went public to pay off its debts; and the “Wal-Mart decade” (actually 1990 to 2002), when Wal-Mart grew to unprecedented size—make the point.

Sam ‘Hustler’ Walton

Sam Walton was born in Kingfisher, Oklahoma in 1918, graduating from the University of Missouri with an economics degree in 1940. His college fraternity brothers gave him the nickname “Hustler,” which stuck.

During World War II, he served as a lieutenant and then captain in U.S. Army Intelligence, supervising security for aircraft plants and Prisoner of War camps in California, and other locations—an intelligence background far above what you would expect for the normal “country boy” soldier, although official and unofficial biographies shed no further light on his intelligence activities.

Walton’s 1943 marriage to Helen Robson, the daughter of L.S. Robson, a prosperous banker and rancher of Claremore, Oklahoma, was more than fortuitous. L.S. Robson lent Walton $20,000, four-fifths of what Sam needed to buy his first store, a Ben Franklin variety store in Newport, Arkansas, in 1945. By 1962, Walton owned and operated 16 Ben Franklin franchise variety stores, mostly based in Arkansas (with a few in Missouri and Kansas).

On July 2, 1962, in Rogers, Arkansas, Walton opened his first discount store, under the Wal-Mart name. The idea of a discount store is to sell a lower line of goods than a regular department store, but also to sell many of the same goods as regular department stores, at a cheaper price. How would that be possible? It required cost-accounting “savings.” The discount store could find some efficiencies of scale, and also operate at a lower profit margin per unit good than a regular department store. But primarily, Walton used two tactics, with regard to labor and suppliers.

First, he resolved to pay his workers less, ferociously resisted any unionization, and restricted most of his workers to working no more than 28 hours per week, which would mean they would not qualify for employee benefits—and would never be able to earn a living wage. He offered some of them health benefits, but most did not earn enough to purchase the health insurance. Though the myth arose that this policy became prevalent only after Walton’s April 1992 death, the fact is that Mr. Sam enforced it from day one. Wal-Mart workers earn wage and benefit packages that are 12-30% below those paid to workers in comparable jobs at unionized companies, depending on the job classification. During most of Sam Walton’s reign, Wal-Mart had a worker turnover rate of an incredible 35-45%.

Second, Walton instituted a policy that suppliers would have to sell goods to Wal-Mart at constantly lower prices, forcing them to cut expenses, which frequently meant cutting wages of their own workers and/or layoffs. Eventually, this led to these suppliers outsourcing their production to overseas sweatshops, a policy that started to gain steam in the 1980s under Sam Walton’s direction.

By 1969, Wal-Mart had grown to $30.8 million in annual sales. It operated 32 stores, most within a 200 mile radius of Bentonville. But to grow this quickly, it had to borrow heavily, and soon had significant debt.

Wall Street Cash Infusion

Wal-Mart faced a financing crunch. We look at two examples from Wal-Mart’s history, which crucially demonstrate that, contrary to its own public relations fairy tales, Wal-Mart would not exist without Wall Street’s direction and ample financial backing.

After Sam Walton started Wal-Mart in 1962, he flew around the American Southeast, Southwest, and Midwest to line up loans for his company. Republic Bank, based in Dallas, Texas, and known for its smarmy dealings, was one of the first lenders to him in the 1960s. But Republic Bank and other banks that lent money to Wal-Mart, set a limit on how much they would lend. Walton revealed in his autobiography, Sam Walton: Made in America, that in 1969, “we weren’t generating enough profits both to expand and pay off our debts…. We really needed the money, pure and simple.”

Walton and his eldest son, S. Robson (Rob) Walton (who is now chairman of Wal-Mart), figured that the only way they could come up with the money to pay their debts, was an Initial Public Offering (IPO), issuing shares of stock to the public.

But there was one catch: A commercial or industrial company cannot conduct an IPO by itself; it must be done by a financial institution. To handle the job, Sam Walton hired two of the world’s most criminally-connected, dirty-money investment banks.

The first was the Little Rock, Arkansas-based Stephens, Inc., which is the largest private investment bank west of the Mississippi. Its founder was Jackson Stephens, who had worked intensively with such dirty operations as the Bank of Credit and Commerce International (BCCI), an intelligence cut-out for the financier oligarchy, which financed illegal weapons and drug trade. In 1990, the BCCI was convicted in Miami, of money laundering for the Colombia cocaine cartels. Published reports have also linked Stephens to work with the U.S. National Security Agency.

The second firm Sam Walton selected to handle his IPO, was the investment bank White Weld. White Weld operates on Wall Street, but its headquarters are in Boston. Walton wrote in his autobiography, “I thought we needed a Wall Street underwriter.” So much for his alleged independence from Wall Street. The founders of White Weld descended from Boston Brahmin families that had been involved in a treasonous plot, the Hartford Convention of 1814, to split apart the United States. Through a series of corporate marriages, White Weld would merge with both the Swiss banking giant Crédit Suisse, as well as the First National Bank of Boston, eventually becoming Crédit Suisse White Weld, one of the world’s largest drug-money laundromats. On Feb. 7, 1985, Federal agents caught Crédit Suisse in a multi-billion-dollar money laundering scheme, for which they were convicted.

These two sinister firms raised more than $4.5 million for Wal-Mart through the Oct. 1, 1970 IPO, and a grateful Mr. Sam placed Jackson Stephens on the board of directors of Wal-Mart.

The ‘Wal-Mart Decade’

The second instance of Wall Street’s massive financing and guiding of Wal-Mart involves the company’s spectacular growth during 1990-2002.

The bankers loved Wal-Mart because it fulfilled their policy of a post-industrial society, whereby America’s productive capacities were ravaged; the nation no longer produced quality goods at decent prices, with a well-paid productive labor force. Instead, it became a consumer society, purchasing goods, produced first at runaway sweatshops in the U.S. South, and eventually at overseas concentration-camp production facilities. Wal-Mart would be the prime seller of these goods. Soon its ferocious methods became the “norm” for America; other retail firms, as well as manufacturers, either adopted the methods of Wal-Mart, or they were gone.

In the late 1980s, the Wall Street-City of London financiers needed greater volumes of loot to prop up the collapsing world speculative bubble. They gouged huge amounts of loot out of the developing sector, under the globalization typified by the North American Free Trade Agreement (NAFTA), which was rammed through the U.S. Congress in 1993, and implemented the following year. Wal-Mart became the ideal vehicle for free-trade and globalization: marketing the goods that developing countries had produced, but for which these countries were paid only a fraction of their real production costs.

Wal-Mart was pumped up to enormous size, accompanied by structural changes, with Wall Street pumping in the money by snapping up Wal-Mart’s corporate bonds.

For most of its existence, Wal-Mart had built only one kind of store, an enormous facility occupying approximately 70,000 square feet in sales space (other department chains’ stores averaged 40,000 square feet). But now, even these stores were no longer big enough. With globalization going through, the United States would receive a flood of imported goods. Both for this, and for advantage against its competitors, Wal-Mart, starting 1987, began to build supercenters, stores with an amazing 180,000 to 200,000 square feet, which sold everything from hard goods to fresh food.

Figure 1 documents the shift in policy. The number of Wal-Mart regular stores rose between 1985 and 1995, although after 1990, the rate of growth slowed. In 1995, the number of Wal-Mart regular stores peaked at 1,995; in the ensuing seven years, the number contracted by more than 400. There were no supercenters in 1985, only five in 1990, but by 2002, there were 1,268—a staggering growth of 25,000% since 1990.

As the second prong of the globalization strategy, Wal-Mart established stores abroad, regimenting foreign markets using the same methods as they did in the United States, thus destroying those countries’ economies. Figure 2 shows that the number of stores that Wal-Mart has built-in foreign countries has risen from 1 in 1990, to 1,288 in 2002. Wal-Mart is now the number one retailer in Mexico, Canada, and other countries. The trajectory of the curves of building Wal-Mart international stores, and of building domestic Wal-Mart supercenters are virtually the same, arising from a single policy.

The furious pace of expansion of Wal-Mart’s operations—a combined total of 2,540 new domestic and international stores since 1990—directly comes from the bankers’ mobilization to expand the process of globalization looting, and from the related policy of the Roman Imperial model. There was an immense cost to carry out the construction, in the tens of billions of dollars. Wal-Mart’s cash flow could not have covered the cost.

Now we see the hand of Wall Street and the City of London, which both shaped the policy initially, and made it work. Figure 3 shows the level of Wal-Mart’s long-term debt, most of which is in the form of bonds. In 1990, Wal-Mart had $740 million in long-term debt; by 2002, it owed $16.6 billion in long-term debt. Notice that this debt curve directly mirrors that of the number of Wal-Mart supercenters, and Wal-Mart international stores. Wal-Mart could only issue this debt due to the fact that the largest Wall Street and London firms were willing to underwrite, market, and sell Wal-Mart’s bonded debt, which ended up in the portfolios of several of these banks, as well as of mutual funds, insurance companies, etc. (Add to this several billion dollars of Wal-Mart’s short-term debt, in the form of commercial paper. Wal-mart’s annual reports do not provide sufficient data to construct a series.)

Contrary to Wal-Mart’s assertions of its independence from Wall Street, reverse the process. It was the Wall Street-imposed paradigm-shift of the post-industrial society since 1963, pushed through Congress, pushed through credit policy administered by the Federal Reserve Board, pushed through the banks swallowing billions of Wal-Mart bonds, that made Wal-Mart what it is, conferring on the company its enormous leverage to loot.

The Family Fortune

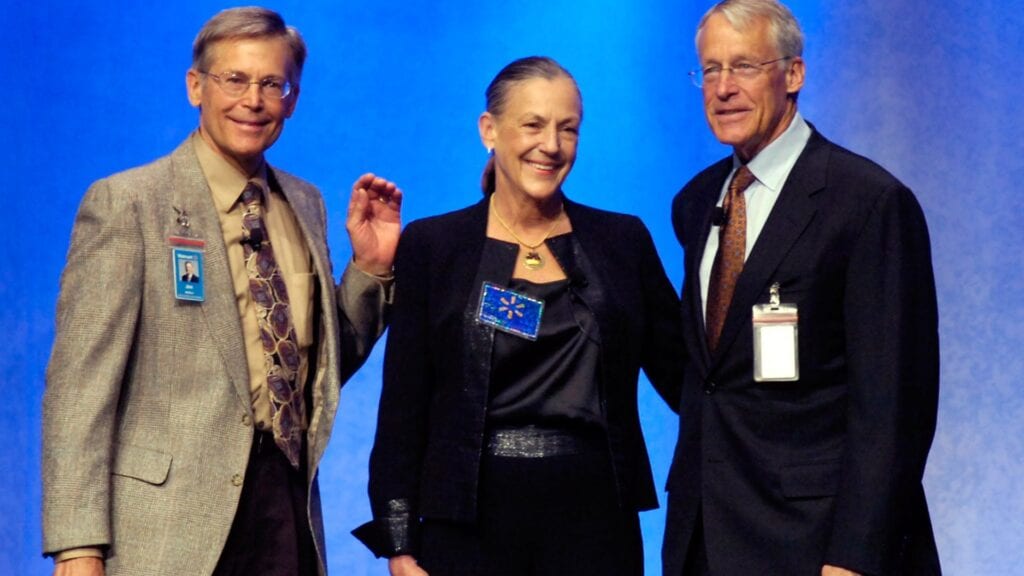

Wal-Mart operated like a large funnel, sucking in the loot from the application of its genocidal austerity policies, both domestically and internationally. This loot has been siphoned off by the Walton family, which owns more than one-third of the company’s stock. On Forbes magazine’s 2002 list of America’s ten richest people, numbers 5 through 9 are occupied by a member of the Walton family: Sam’s widow Helen; son Rob, who is chairman of Wal-Mart; son John, who is chairman of the family’s bank, Arvest; son Jim; and daughter Alice. The value of Wal-Mart stock had risen, so that Wal-Mart has the third largest market capitalization of any American company.

Figure 4 demonstrates that in 1992, the family was worth approximately $8 billion. Today, it is worth $102.5 billion. Upon these assets, the Waltons earn—mostly from stock dividends—half a billion dollars a year. This money was accumulated from the process of destroying the world economy and its labor force.

Having a bigger fortune than any family in the history of mankind, the Waltons are deploying it for evil purposes. First, of course, through their controlling share of stocks in Wal-Mart, the family plans to continue and enlarge upon Sam Walton’s murderous policy for the comany itself. But there is more.

According to the Walton Family Foundation, Inc.’s annual tax returns (form 990-PF), it funds some of the leading forces of the neo-conservative movement, which are part and parcel of Vice President Dick Cheney’s Synarchist apparatus: the Cato Institute, the Heritage Foundation, the Hudson Institute (a Cheney base of operations), the Manhattan Institute, the Landmark Legal Foundation, the National Right to Work Legal Defense & Education Foundation, and others. It also funds environmental groups, which, though identified as liberal, seek to tear down modern industrial society, such as the National Wildlife Foundation and the Nature Conservancy of Arkansas and of California.

Further, the Walton family, particularly John Walton, who runs the family’s Arvest Bank, has functioned as a money pump for neo-conservative causes. Exemplary is its backing of Jeb Bush, the Republican governor of Florida and brother of President George Bush, who is a cog in Attorney General John Ashcroft’s domestic fascist program. Jeb also heavily interfaces with right-wing Cuban networks based in Florida, who are involved in the drug trade. In 2002, when Democrat Bill McBride made a stiff challenge to Bush in Florida’s gubernatorial race, the California-domiciled John Walton sent $325,000 to the Florida Republican Party, which money was whisked into Jeb Bush’s campaign account. Bush won the election. Though not a Floridian, Walton was the largest single individual contributor to Bush during the Florida election. Florida is also a key state for the Republicans in the 2004 Presidential election.

The Waltons are using their money to build up a banking empire, which apparently would give them one of the largest banks in the United States and the world. They have anchored this quest, which is two decades in the making, upon Arvest Bank, which is family owned, and secondarily, through Wal-Mart Stores, Inc.

The Walton family has carefully shepherded its Arvest Bank Holding Company—which owns its Arvest Bank—into a bank with $6.6 billion in assets, and $5.4 billion in deposits. It is already one of America’s 75 biggest banks, but that is not good enough for the Waltons. The bank is chaired by John Walton and has grown through gobbling up other banks. For example, on Dec. 11, 2003, Arvest put the finishing touches on its acquisition of Superior Financial Corp, which has 22 locations in the state of Arkansas. Arvest now operates more than 200 branches in four states, and has the second highest bank market share in Arkansas and the sixth largest bank market share in Oklahoma. It is building on the same rapacious principles by which it built Wal-Mart, starting in Arkansas and neighboring states, and spreading out from there.

In addition, the Waltons’ Wal-Mart Stores, Inc. has made attempts to buy banks in its own name.

The Walton Family Foundation is also the largest funder for the school privatization movement in America, which would dismantle the public education system.

The Walton family is a predatory bunch; the best way to eliminate their devastating effect on the United States and the world, would be to dismantle their Wal-Mart corporate empire, as LaRouche has demanded.