Done Deal: BRICS Establish $100bn Bank to Cut Out Western Dominance

Russia’s President Vladimir Putin, India’s Prime Minister Narendra Modi, Brazilian President Dilma Rousseff, China’s President Xi Jinping and South Africa’s President Jacob Zuma join their hands during the official photograph of the 6th BRICS summit in Fortaleza, Brazil, on July 15, 2014.

(RT) The group of emerging economies signed the long-anticipated document to create the $100 bn BRICS Development Bank and a reserve currency pool worth over another $100 bn. Both will counter the influence of Western-based lending institutions and the dollar.

The new bank will provide money for infrastructure and development projects in BRICS countries.

The countries’ finance ministers signed the memorandum of understanding in Fortaleza, Brazil on Tuesday, the first day of the BRICS 6th summit. Documents on cooperation between BRICS export credit agencies and an agreement of cooperation on innovation were also inked.

Each BRICS member is expected to put an equal share into establishing the startup capital of $50 billion with a goal to reach $100 billion. The BRICS bank will be headquartered in Shanghai and India will preside as president the first year, and Russia will be the chairman of the representatives. Each country will send either their finance minister or Central Bank chair to the bank’s representative board.

Leaders from the five nations – Russia’s President Vladimir Putin, Brazil’s Dilma Rousseff, China’s Xi Jinping, India’s Narenda Modi, and South Africa’s Jacob Zuma, were all in attendance.

The $100 billion emergency lending pool, called the Contingent Reserve Arrangement (CRA), was also established. China will contribute the lion’s share, about $41 billion, Russia, Brazil and India will chip in $18 billion, and South Africa, the newest member of the economic bloc, will contribute $5 billion.

The big launch of the BRICS bank is seen as a first step to break the dominance of the US dollar in global trade, as well as dollar-backed institutions such as the International Monetary Fund (IMF) and the World Bank, both US-based institutions BRICS countries have little influence within.

Membership may not just be limited to just BRICS nations, either. Future members could include countries in other emerging markets blocs, such as Mexico, Indonesia, or Argentina, once it sorts out its debt burden.

The group has already created the BRICS Stock Alliance an initiative to cross list derivatives to smooth the path for international investors interested in emerging markets.

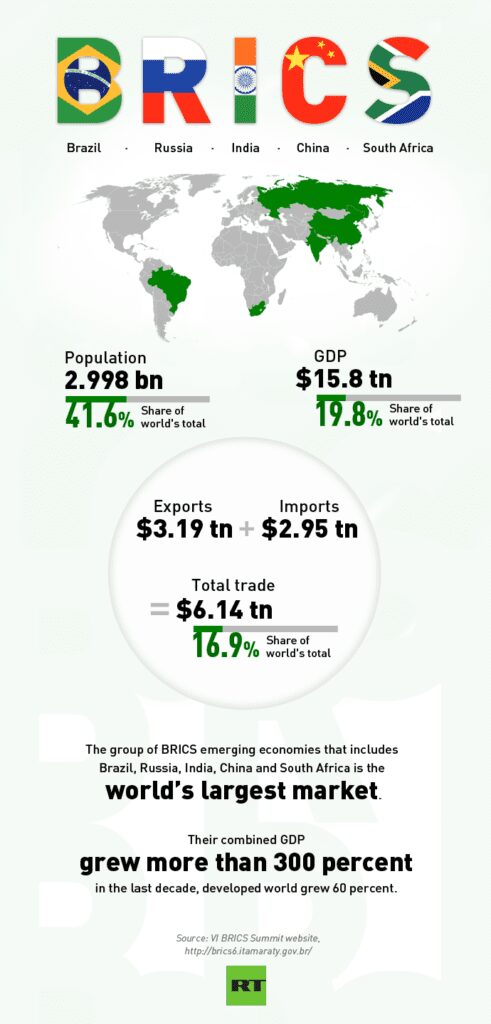

BRICS represents 42 percent of the world’s population and roughly 20 percent of the world’s economy based on GDP, and 30 percent of the world’s GDP based on PPP, a more accurate reading of the real economy. Total trade between the countries is $6.14 trillion, or nearly 17 percent of the world’s total.