9 Factors That Can Influence the Price of Bitcoin

When Bitcoin first appeared, no one could have guessed what scale it would take and how much it would be worth more than a decade later. At that time, even the creator himself would not have thought that this cryptocurrency would be a pioneer in the entire market, that it would be worth tens of thousands of dollars, but that that value would depend on factors that it could not influence.

What we know about Bitcoin are the following things:

- First appeared on the market as a digital decentralized currency in 2009

- The identity of the creator is still a mystery

- Transaction costs are low because there is no control by the authorities

- They have no physical equivalent of digital currency

- Mining takes place through a network known as a blockchain

- Bitcoin mining consumes a lot of time and electricity

- Their number in circulation is limited

- Cryptocurrencies can be traded through trading platforms

The value of Bitcoin is always a turbulent topic. This currency used to be worth a few dollars, for today, at the time of writing, it was $ 39,000. This is a high value, but we all remember the all-time highest in November 2024, when it reached a value of $ 68,000. As you can see, these are big variations in value in a very short period of time, from just a few months.

Following the news related to this cryptocurrency is important, especially if you are interested in investing or trading yourself. Specialized sites can help you with this, and if you click here, you will find a perfect example of what relevant sources of timely information should look like. Informing is crucial, because that way you will understand the factors that affect the price of Bitcoin, so you can estimate what will happen next in this market.

However, there are several factors that can be proven to change the price, such as:

1. The number of Bitcoins available in a blockchain

Initially, 21 million Bitcoins were available in the blockchain. At the moment, that number is significantly reduced, ie it is estimated that 19 million have already been mined. The less Bitcoin there is to mine, the more their value grows. This is why in the beginning their rates were really low, and now almost no one can afford to buy a whole BTC, instead of periodically taking parts of it.

2. Increased or decreased demand

Similar to trading, these rules are reflected in the crypto market. When there is an increased demand for something, it is natural for their price to rise. When there is no interest, prices fall. This is also the case with BTC, especially when new cryptocurrencies emerge that attract more attention and are more interesting to investors and traders.

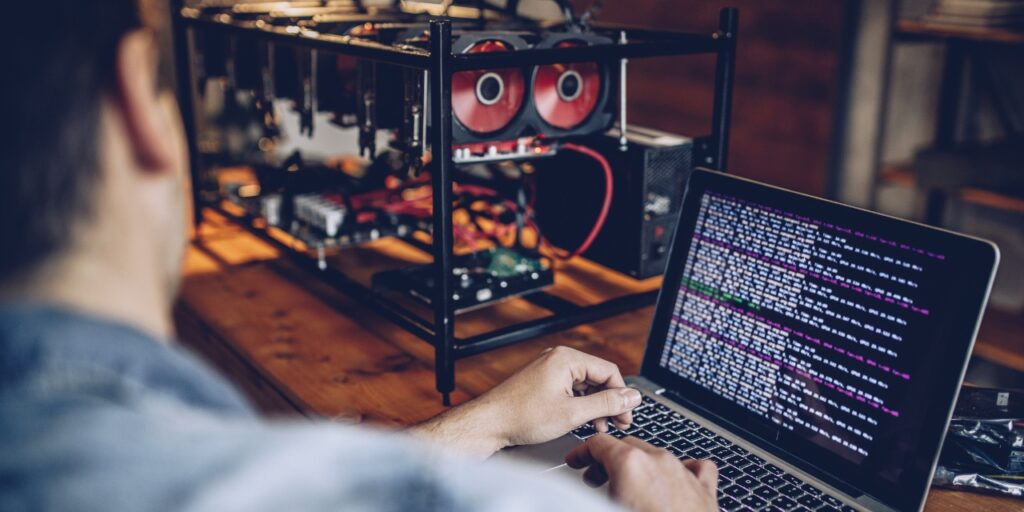

3. The cost incurred in the mining process

Mining is a long and expensive process, so it is quite expected that the consumption of resources will affect the value of the cryptocurrency. Graphics cards and machines known as rigs really consume a lot of power to run as many Bitcoins as possible.

4. The number and value of competing cryptocurrencies

Even for BTC, competition can be a big enemy. Although it seems that the first place in the crypto world is undisputed for Bitcoin, it can easily happen that a more attractive currency will appear, which will steal the spotlight. You’ve probably noticed that some altcoins rise when BTC falls, but there are some that are tied to its value.

5. Their regulation and the ways in which they are used

Everyone would like the regulation of cryptocurrencies, but that would mean giving them official status and the authorities and central banks taking control, or at least part of it. In that way, the basic concept of being decentralized and independent would be completely lost. If that happens, it is quite expected that the value of Bitcoin and all other cryptocurrencies that would be regulated will fall.

6. New technologies for altcoins

Bitcoin already uses a protocol we know and new innovations would mean a lot of work and investment. But newer cryptocurrencies have a better chance of adapting to new technologies. Although BTC is not threatened by this, for the time being, it does not mean that it will remain protected in the future, especially if the new currencies are more innovative and more optimized.

7. The interest of institutions and large companies

An interesting phenomenon is that the value of Bitcoin and cryptocurrencies, in general, grows if a public figure, institution, or large company shows interest in them. Recall, a tweet by Elon Musk was enough to change the downward trend in the value of this cryptocurrency, for it to literally regenerate overnight and the value to grow dramatically.

8. Media influence

No one should ever neglect the influence of the mass media in society. They inform, create public opinion, and serve to keep readers up to date. However, the analysis, columns, research, and the representation of cryptocurrencies as a topic in the daily news, can contribute to the value of Bitcoin and its competitors to change over time.

9. Current events in the world

We all remember that covid-19 caused the value of BTC to fall and that really is a lot. But we have also witnessed how it regenerates after a process called halving and grows dizzyingly, even when the world was in a strong wave of pandemics. Although the impact is not too great, current events can limit interest and distribution, so that it reflects on the value.

Conclusion

As you can see, there are many factors that influence the change in the price of Bitcoin. And from what we can understand so far, this currency is really fragile and unstable, or in a word, volatile. The nature of BTC is such, precisely because of independence and decentralization, and therefore there will be such jumps in value in the future, or at least as long as there is enough supply to mine and trade.