What Are Debt Collection Agents and How They Work?

Debt collection agents play a crucial role in the financial ecosystem. They act as intermediaries between creditors and debtors to recover outstanding debts.

This article explores debt collection agents’ responsibilities, methods, and ethical considerations. We will also focus on their critical function in maintaining financial stability.

The Role of Debt Collection Agents

Debt collection agents, also known as debt collectors or debt recovery agents, are professionals hired by creditors. They pursue the repayment of outstanding debts from individuals or businesses. These debts may range from unpaid loans and credit card balances to overdue bills for goods and services.

Debt collection is governed by stringent laws. These laws outline the permissible actions that debt collectors can take. Compliance is essential to ensure fair and ethical debt collection practices.

How Debt Collection Agents Work

Here are the various aspects of the work of debt collectors.

Communication

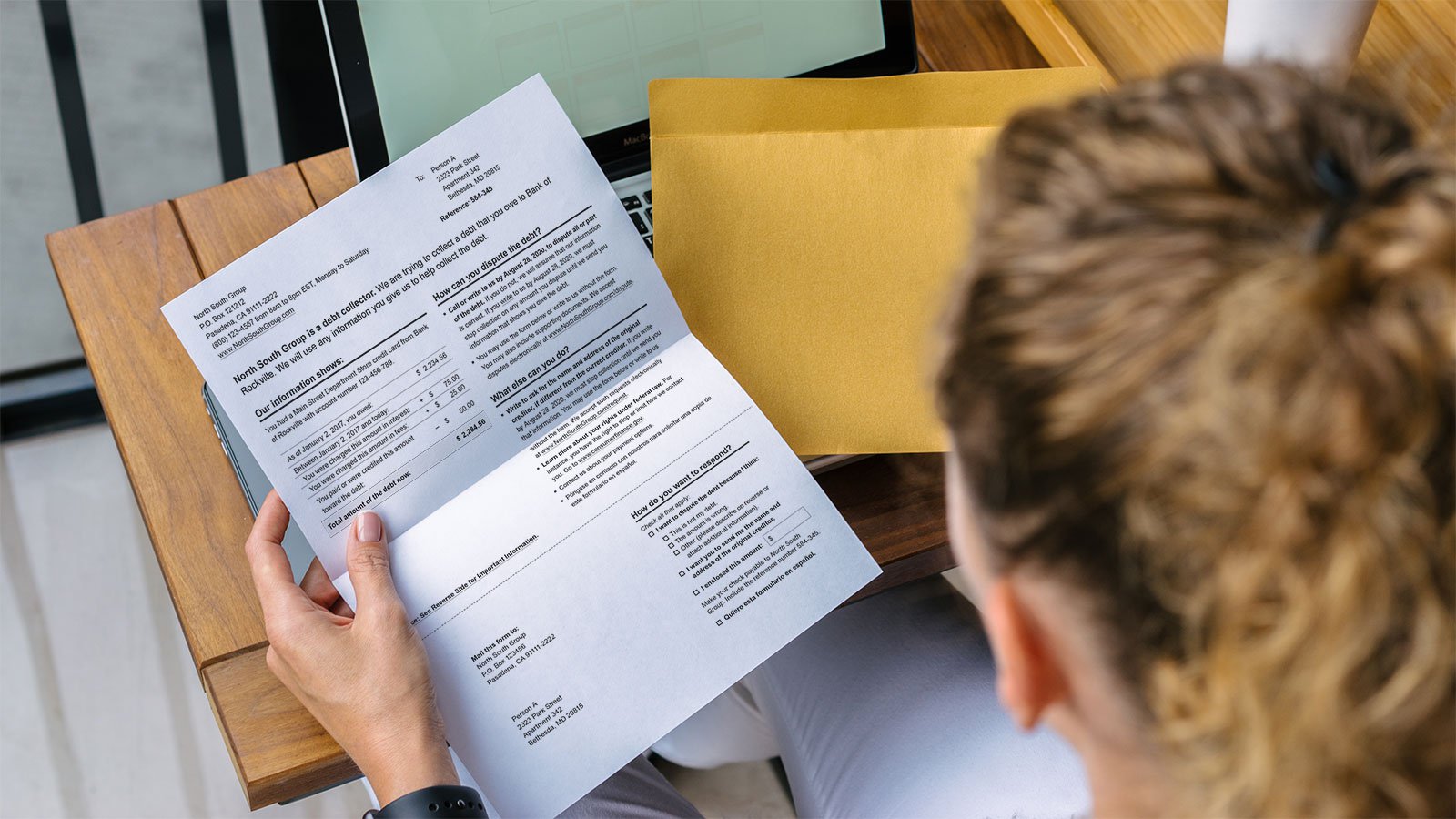

Debt collection agents initiate contact with debtors to discuss the outstanding debt. Communication channels may include letters, emails, and phone calls. These interactions are conducted professionally and adhere to the guidelines set forth by the relevant legal frameworks.

Negotiation

Debt collectors receive training to negotiate repayment plans mutually acceptable to both parties. They may offer flexibility regarding installment plans or reduced settlement amounts by considering the debtor’s financial circumstances.

Using technology

Debt collection has been significantly influenced by technology in modern times. Debt collection agencies often use employee monitoring software to track and optimize workflows. The software helps manage communication and maintain compliance with relevant regulations.

Technologies in Debt Collection

Here are some possible technology tools used in debt collection.

Employee monitoring software

Employee monitoring software is a vital tool for debt collection agents. It allows agencies to track their agents’ performance to ensure they adhere to legal and ethical standards.

Time card app

Efficient time management is crucial in the debt collection industry. Time card apps enable agents to log their working hours accurately to ensure they are compensated fairly. These apps contribute to streamlined operations and transparency in the billing process.

Ethical Considerations in Debt Collection

Here are some ethical considerations related to debt collection.

Professional Conduct

Debt collection agents are bound by ethical standards that require them to treat debtors with dignity. They cannot engage in abusive language or any form of harassment.

Adherence to these standards is a legal requirement and essential for maintaining the reputation of the debt collection agency.

Privacy concerns

Debt collectors handle sensitive information about debtors. They must prioritize data privacy. Compliance with data protection regulations ensures debtor information is secure.

Challenges in Debt Collection

While debt collection agents play a vital role in facilitating the financial health of businesses and creditors, they have their share of challenges.

Navigating these hurdles requires a combination of resilience and adaptability. Here are some prominent challenges faced by debt collection agents.

Changing regulatory landscape

The legal framework governing debt collection practices undergoes regular updates and amendments. Debt collection agents must stay informed about these changes to ensure compliance.

Failure to adhere to the latest regulations can lead to legal consequences and tarnish the reputation of the collection agency.

Compliance complexity

Besides keeping up with evolving regulations, the complexity of compliance poses a significant challenge. Different jurisdictions may have distinct rules governing debt collection.

Debt collection agencies operating across borders must navigate a maze of legal requirements. It is crucial to establish robust compliance management systems.

Consumer protection concerns

The debt collection process involves interacting with individuals facing financial hardships. Balancing the need for debt recovery with consumer protection is a delicate task.

Agents must be vigilant to avoid engaging in practices deemed as harassment or other forms of abusive behavior. Striking the right balance between assertive debt recovery and respecting the rights and dignity of debtors is an ongoing challenge.

Managing customer relationships

Maintaining positive relationships with debtors while pursuing debt recovery is a challenge. Effective communication is crucial.

However, debt collection agents encounter resistance and frustration from individuals facing financial difficulties. Developing empathy and understanding the debtor’s perspective is essential to prevent strained relationships that impede the collection process.

Technological integration

While technology enhances the efficiency of debt collection, its integration is challenging. Debt collection agencies must invest in and adapt to new technologies, which can be resource-intensive.

Additionally, there may be resistance from staff accustomed to traditional methods. It highlights the need for comprehensive training programs to ensure a smooth transition.

Data security and privacy

Debt collection involves the handling of sensitive personal and financial information. Ensuring the security and privacy of this data is a critical challenge.

With the rise of cybersecurity threats, debt collection agencies must invest in robust data protection measures. It can help safeguard against breaches that could compromise the confidentiality of debtor information.

Economic volatility

Economic fluctuations can impact the ability of debtors to repay their debts. During economic downturns, individuals and businesses may face increased financial strain.

It can make debt recovery more challenging. Debt collection agents must adapt their strategies to accommodate the economic context.

Reputation management

The debt collection industry faces negative stereotypes, and maintaining a positive reputation is a persistent challenge.

Instances of aggressive or unethical debt collection practices can tarnish the image of individual agents and the agencies they represent. Building and preserving trust with creditors and debtors is crucial for long-term success in the industry.

Bottom line

Debt collection agents play a crucial role in the financial landscape. They facilitate the recovery of outstanding debts while adhering to legal and ethical standards. The integration of technology enhances the efficiency of debt collection operations.

As the industry evolves, ongoing adaptation to regulatory changes and technological advancements will be critical for the continued effectiveness of debt collection agencies.

Striking a balance between assertive debt recovery and ethical conduct ensures the debt collection process remains fair and respectful of the dignity of debtors.